In a new report The LGPS: unsustainable, published by the Centre for Policy Studies on Thursday 17 December, Michael Johnson reveals that notwithstanding Lord Hutton’s 2014 reforms, the scheme’s financial deterioration continues, first reported in 2011 in Self-sufficiency is the key.

In a new report The LGPS: unsustainable, published by the Centre for Policy Studies on Thursday 17 December, Michael Johnson reveals that notwithstanding Lord Hutton’s 2014 reforms, the scheme’s financial deterioration continues, first reported in 2011 in Self-sufficiency is the key.

The scheme ultimately risks running out of cash to meet pensions in payment, because of excessive pension promises relative to contributions. This has been facilitated by years of abysmally ineffective governance, becoming ever more complex with the introduction of Pension Boards. The LGPS is a national embarrassment. Meanwhile, it continues to be unable to show adherence to the old adage of what gets measured gets managed, its cost reporting being an expensive work of fiction. Cultural change is required, but that could take another decade to materialise: too late to save the scheme.

Michael Johnson comments:

“The LGPS is huge: it matters. At end-March 2015, it had assets of £214 billion and 5.17 million members, more than 10% of all adults in the UK. During the last year, had employer contributions not risen substantially (by £833 million), cashflow would have continued its long-term deterioration. This unambiguously signals that the LGPS is unsustainable. Given that employer contributions are predominately taxpayer-funded, a surreptitious state-funded bailout has commenced. But….over the next decade the scheme faces a perfect storm, due to a combination of:

- past under-funding;

- the end of contracting out rebates (April 2016; costing some £700 million per year);

- potentially sclerotic investment returns in a post-QE world;

- employers opting out of the scheme;

- destructive demographics (the membership is both living longer and ageing);

- mis-aligned cost and income drivers;

- a crippling accrual rate (increased by 63% in 2014); and

- ten year grandfathering from 2014, which effectively renders Lord Hutton’s (cost-saving) proposals impotent for a decade.

And while 2013’s £47 billion deficit is expected to increase at the next triennial valuation (March 2016), it is negative cashflow that is likely to be the LGPS’s undoing.”

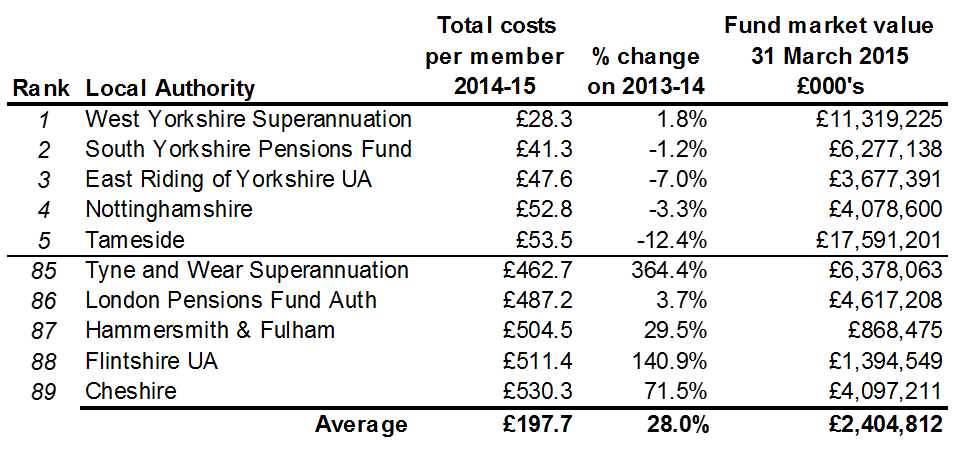

The paper includes “league” tables that reveal an incredible range in the operating costs of individual LGPS funds. For example, Cheshire’s reported total costs per member are nearly 19 times those of West Yorkshire’s.

Total reported costs per member, in ascending order

One would like to think that Cheshire’s s101 Pensions Committee, and its Pension Board charged with “assisting” the administering authority, are asking themselves the question: how did West Yorkshire do that? Considerable curiosity is required, informed by a good understanding of the industry (which some s101 Pensions Committees lack).

To read the full report, including cost league tables, click here.

Note: This paper is a prelude to the author’s next paper, (to be published shortly), which discusses the Chancellor’s recent proposal to reconfigure the 89 LGPS funds as up to six British Wealth Funds, with an infrastructure bias. This will not head off the looming cashflow crisis. The paper will include specific proposals to make the LGPS sustainable for the long term.