The Centre for Policy Studies welcomes a proposal adopted by Steve Webb MP to encourage pensions contributions with the introduction of a 33% flat rate of tax relief.

Speaking in a debate yesterday the Pensions Minister announced plans for savers to receive a £1 tax rebate for every £2 they pay into a pension.

Speaking in a debate yesterday the Pensions Minister announced plans for savers to receive a £1 tax rebate for every £2 they pay into a pension.

As proposed by Michael Johnson in Retirement Savings Incentives, published by the Centre for Policy Studies on 21 April 2014, tax relief on pension contributions should be replaced by a Treasury contribution of 50p per £1 saved, up to an annual allowance, paid irrespective of the saver’s taxpaying status.

Author Michael Johnson comments:

“We are delighted to have swayed the minister on the matter of tax relief. This reform would be a significant step towards improving the effectiveness of HMT’s investment, the purpose of which should be to encourage a broad-based savings culture, i.e. more people saving more.

Today’s framework of tax relief is faced with a fundamental conundrum. Given that Income Tax is progressive, then tax relief is regressive, so much so that it is more of a personal tax management tool for the wealthy than an incentive to save. There is plenty of evidence that the wealthy will save anyway, regardless of a 40% or 45% tax relief.”

As explained in the report:

‘If we are to catalyse a broad based savings culture, we need a highly redistributive incentives structure. A 33% flat rate of tax relief (i.e. 50p from the Treasury per £1 saved from net income, which could include employer contributions) would double the incentive that basic rate taxpayers currently receive. This is not necessarily intuitive; the doubling arises because tax relief is calculated on gross (i.e. pre-tax), rather than net amounts. But, for cost control purposes, it would have to be accompanied by a much lower annual allowance, i.e. well below today’s £40,000. In addition, to help broaden the savings base, the saver’s taxpaying status should be irrelevant.

It would make sense for employees’ income tax and NICs to be deducted from employers’ contributions, with the Treasury’s 50p paid gross, thus avoiding a potential cashflow issue for employees.

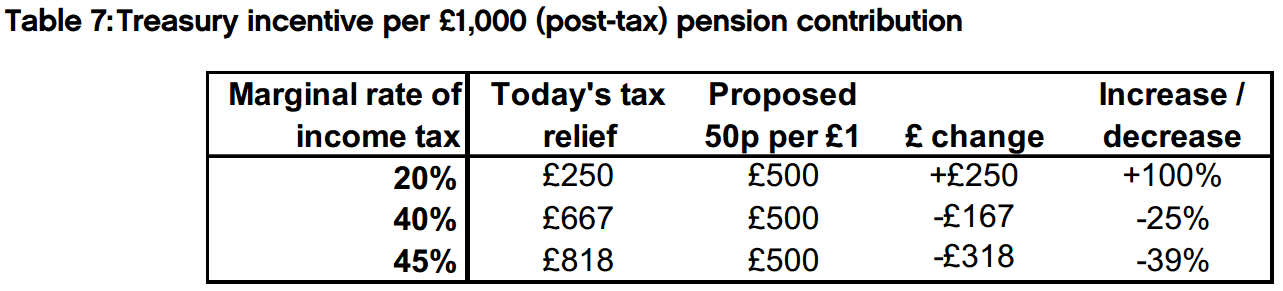

Table 7 compares the proposed 50p per £1 incentive with today’s framework of tax relief. Clearly, basic rate taxpayers would benefit under the proposed 50p per £1 arrangement, with higher and additional rate taxpayers receiving a reduced incentive relative to today, consistent with a more redistributive structure.’

Click here to read the full report.

Date Added: Thursday 12th February 2015