With the Bank of England Monetary Policy Committee meeting on 7th December, updated research from the Centre for Policy Studies shows that the MPC’s forecasting record has continued to deteriorate given outturn in the past four quarters. In Factsheet 6 UPDATE: the recent history of MPC inflation forecasts, Ryan Bourne shows that:

With the Bank of England Monetary Policy Committee meeting on 7th December, updated research from the Centre for Policy Studies shows that the MPC’s forecasting record has continued to deteriorate given outturn in the past four quarters. In Factsheet 6 UPDATE: the recent history of MPC inflation forecasts, Ryan Bourne shows that:

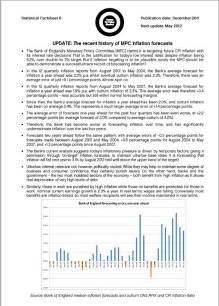

- Between 2001 and 2004 the forecasts were almost spot on. In the 12 quarterly inflation reports from August 2001 to May 2004, the Bank’s average forecast for inflation a year ahead was 2.2% p.a. whilst eventual outturn inflation was 2.3%. Therefore, there was an average error of just +0.1 percentage points.

- In the 12 quarterly inflation reports from August 2004 to May 2007, the Bank’s average forecast for inflation a year ahead was 1.9% p.a. with outturn inflation of 2.3%. This average error was therefore +0.4 percentage points – less accurate but still within normal forecasting margins.

- However, since August 2007, the Bank’s average forecast for inflation a year ahead was 2.0%, and outturn inflation was 3.4% p.a. This represents a much larger average error of +1.4 percentage points. Considering that inflation was only meant to be 2.0%, this is a significant error.

- This means that average outturn of the past four quarters of realised inflation was underestimated by +2.2 percentage points a year beforehand.

Given the justification for current ultra-low interest rates is the forecasting of low inflation in the medium-term, these forecasting errors are cause for concern. Now, the bank is forecasting that inflation will still be above target at 3.1% by Q3 2011 and will fall below target by the start of 2013.

With current average earnings growth of just 2.3% p.a., the public will hope that the Bank’s forecasts going forward are more accurate than those realised in the previous four years.